Many individuals nearing retirement age often wonder how Social Security will influence their overall retirement strategy. Understanding the ins and outs of how this government program works is crucial in planning for a secure financial future. From determining the best time to start collecting benefits to knowing how much you can expect to receive, Social Security plays a significant role in shaping your retirement income. Let’s explore the impact of Social Security on your overall retirement plan.

Key Takeaways:

- Maximize Social Security Benefits: Understanding how to maximize your Social Security benefits can significantly impact your overall retirement income and lifestyle.

- Timing Matters: The age at which you choose to start receiving Social Security benefits can greatly influence the amount you receive each month throughout your retirement years.

- Integration with Other Retirement Income: Social Security should be considered as part of a comprehensive retirement strategy that includes savings, investments, and other sources of income.

Social Security Basics

What is Social Security?

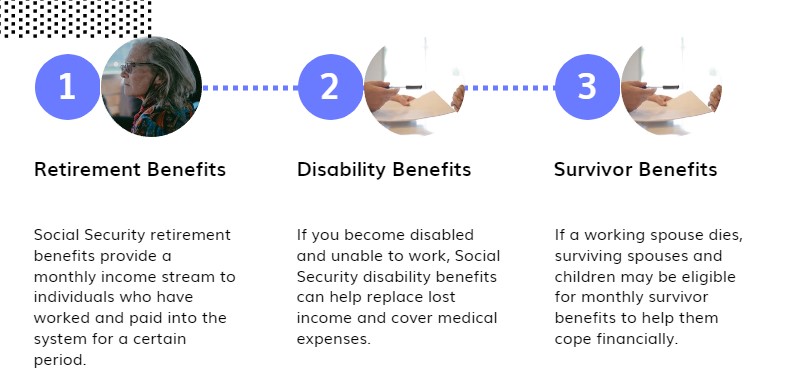

To understand how Social Security impacts your overall retirement strategy, it’s crucial to grasp what Social Security is. Social Security is a federal program that provides financial assistance to individuals who are retired, disabled, or survivors of deceased workers. It is funded through payroll taxes, which are deducted from your paycheck during your working years.

How Does Social Security Work?

Social Security benefits are based on your lifetime earnings. The more you earn and contribute to the program through payroll taxes, the higher your benefits will be when you retire. Retirement benefits are calculated based on your 35 highest-earning years, adjusted for inflation. The age at which you can start receiving full benefits is currently between 66 and 67, depending on your birth year.

What’s important to note is that while Social Security can provide a reliable source of income during retirement, it should not be relied upon as your sole source of income. Delaying claiming benefits can lead to higher monthly payments, so it’s crucial to consider the best strategy for maximizing your benefits based on your individual circumstances.

Retirement Strategy Fundamentals

Some key fundamentals to consider when planning for retirement include defining your retirement goals and assessing your current financial situation. By taking these steps, you can create a solid foundation for your retirement strategy that incorporates Social Security benefits effectively.

Defining Your Retirement Goals

Goals are imperative when planning for retirement as they help you determine how much money you will need to live comfortably during your golden years. Consider factors such as the age you plan to retire, desired lifestyle, and any big expenses you anticipate, like travel or healthcare costs. By setting clear goals, you can create a roadmap for your retirement savings and adjust as needed along the way.

Assessing Your Current Financial Situation

With a detailed understanding of your current financial situation, you can make informed decisions about how to save and invest for retirement. Analyze your income, expenses, assets, and debts to get a clear picture of where you stand financially. This assessment will help you identify areas where you can cut back on spending, increase savings, or pay down debt to strengthen your overall financial position.

To maximize your retirement savings and optimize your Social Security benefits, it’s crucial to have a comprehensive understanding of your financial goals and current situation. By defining your retirement goals and assessing where you stand financially, you can create a personalized retirement strategy that aligns with your aspirations and sets you up for a secure future.

The Role of Social Security in Retirement

Despite the various retirement savings vehicles available today, Social Security remains a crucial component of most Americans’ retirement income strategy. Social Security provides a steady, reliable source of income that is adjusted for inflation, offering a level of financial security throughout retirement.

How Social Security Fits into Your Retirement Income

Social Security benefits are designed to replace around 40% of pre-income for the average earner. For many retirees, this percentage can be even higher, making Social Security a foundation of their retirement income. By understanding how Social Security benefits are calculated and the best time to start claiming them, you can better plan for a secure retirement.

Strategies for Maximizing Social Security Benefits

An important strategy for maximizing Social Security benefits is to delay claiming them until full retirement age or even later. This can result in significantly higher monthly benefits for the rest of your life. Additionally, coordinating benefits with a spouse can lead to even more substantial income during retirement.

Plus, carefully considering your health and family longevity can help determine the optimal time to start claiming Social Security benefits. By maximizing your benefits, you can enhance your overall retirement income and financial security.

Impact on Retirement Savings

To Understanding Social Security Retirement Benefits is crucial in determining how it affects your retirement savings.

How Social Security Affects Your Retirement Savings Rate

Rate: Social Security can play a significant role in determining your overall retirement savings rate. Understanding the benefits you are eligible for can help you adjust your savings goals accordingly. By taking into account your estimated Social Security income, you can calculate how much additional savings you need to cover your retirement expenses.

Adjusting Your Savings Strategy Based on Social Security

Impact: Your Social Security benefits can impact the amount you need to save for retirement. By incorporating these benefits into your overall retirement strategy, you can potentially lower the amount you need to save on your own. This can free up more money for other financial goals or improve your current lifestyle.

Taxes and Social Security

Many individuals may not realize that Social Security benefits could potentially be subject to taxes in retirement. To understand the impact of taxes on your Social Security benefits, it’s imperative to educate yourself on the subject. You can refer to resources like Understanding Social Security and its Impact on Your Retirement Strategy to gain valuable insights.

How Social Security Benefits Are Taxed

Social Security benefits can be taxed based on your provisional income, which includes half of your Social Security benefits plus other sources of income like wages, self-employment, pensions, and investment income. The portion of benefits subject to taxation can range from 0% to 85%, depending on your filing status and income levels.

Minimizing Taxes in Retirement with Social Security

Taxed-smart retirees can employ strategies to minimize the impact of taxes on their Social Security benefits. For instance, by carefully managing withdrawals from retirement accounts and utilizing tax-efficient investment vehicles, individuals can potentially reduce their taxable income in retirement. Maximizing contributions to Roth IRAs and coordinating with a financial advisor to develop a tax-efficient retirement income plan are crucial steps in optimizing tax savings during your retirement years.

Other Sources of Retirement Income

Your Benefits Planner: Retirement | What Important Things to … can help you understand the various ways to supplement your retirement income beyond Social Security benefits. It’s crucial to explore additional revenue streams to ensure a comfortable and secure retirement.

Supplementing Social Security with Other Income Streams

For financial stability in retirement, it’s imperative to consider supplementing your Social Security benefits with other income sources. This could include retirement savings accounts like a 401(k) or IRA, investment portfolios, rental properties, or part-time work. Diversifying your income streams can help you maintain a steady cash flow and buffer against economic downturns.

Creating a Diversified Retirement Income Portfolio

Creating a diversified retirement income portfolio involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and annuities. This strategy helps reduce risk and ensures you have a mix of income sources that can withstand market fluctuations. It’s important to regularly review and adjust your portfolio as you near retirement to ensure it aligns with your financial goals.

Conclusion

Hence, it is crucial to consider Social Security as a key component of your overall retirement strategy. Understanding how Social Security benefits work and when to start taking them can have a significant impact on your financial well-being in retirement. By maximizing your benefits and incorporating them into your broader retirement plan, you can ensure a more secure and comfortable future for yourself.

Do not forget, Social Security should not be relied upon as your sole source of income in retirement. It should be viewed as a valuable supplement to your savings and investments. By developing a comprehensive retirement strategy that takes Social Security benefits into account, you can better prepare for a financially stable retirement.

FAQ

Q: What is Social Security and how does it impact my overall retirement strategy?

A: Social Security is a government program that provides financial benefits to retirees, disabled individuals, and survivors. It can play a crucial role in your overall retirement strategy by providing a steady income stream during your retirement years.

Q: When should I start claiming Social Security benefits?

A: The age at which you start claiming Social Security benefits can significantly impact the amount you receive. While you can start claiming as early as age 62, delaying benefits until full retirement age (usually between 66 and 67) or even later can result in higher monthly payments.

Q: How does my work history impact my Social Security benefits?

A: Your Social Security benefits are based on your earnings history, specifically the 35 years in which you earned the most. The more you earned over your career, the higher your benefits are likely to be. It’s important to ensure your earnings record is accurate to receive the full benefits you are entitled to.

Q: Can I work and receive Social Security benefits at the same time?

A: Yes, you can work and receive Social Security benefits simultaneously. However, if you are below full retirement age, your benefits may be reduced if your earnings exceed a certain limit. Once you reach full retirement age, there is no limit on how much you can earn while receiving benefits.

Q: What are some strategies to maximize Social Security benefits in my overall retirement plan?

A: Some strategies to maximize Social Security benefits include delaying benefits to increase monthly payments, coordinating spousal benefits, and considering your overall retirement income sources. It’s important to factor in Social Security as part of your holistic retirement plan to ensure financial stability in your golden years.