You are initiateing on an exciting journey into the world of trading, and it’s important to build a strong foundation. Understanding the right research techniques can significantly enhance your trading skills. In this blog post, you will discover various methods, tools, and resources that can empower your decision-making. Whether you’re interested in technical analysis, fundamental analysis, or market sentiment, implementing these strategies will help you grasp the important concepts needed to navigate the trading landscape with confidence.

Key Takeaways:

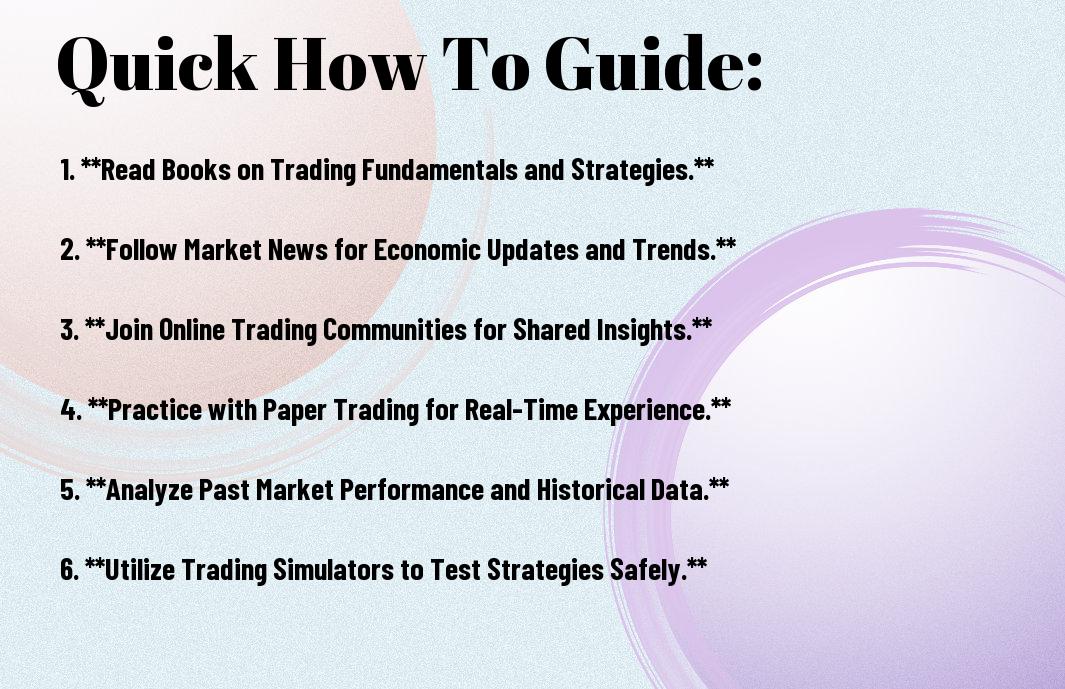

- Start with Fundamental Analysis: Understanding financial statements and economic indicators is crucial for beginners to gauge a company’s health and market potential.

- Utilize Technical Analysis: Learn to read charts and apply indicators to identify patterns and trends which can inform entry and exit points in trading.

- Practice with Paper Trading: Before investing real money, use virtual trading accounts to test strategies and gain confidence without financial risk.

- Stay Informed on Market News: Regularly follow reliable news sources and platforms for economic reports, market trends, and company updates to make informed decisions.

- Join a Trading Community: Engaging with other traders through forums or social media can provide insights, support, and diverse perspectives that enhance learning.

Understanding the Basics of Trading Research

Before exploring into the complexities of trading, it’s imperative to ground yourself in the fundamentals of trading research. This involves understanding the various components that shape market dynamics, which can greatly influence your trading decisions. You should familiarize yourself with economic indicators, market trends, and the impact of global events on asset prices. Having a solid grasp of these concepts can help you evaluate potential opportunities and risks, allowing you to trade with more confidence.

How to Set Clear Goals for Your Trading Journey

You need to start your trading journey by establishing clear and achievable goals. This will not only give you direction but also help you maintain focus during your trading process. Ask yourself what you hope to accomplish—whether it’s generating a specific amount of income, building a long-term investment portfolio, or mastering a particular trading strategy. Documenting these goals can serve as a powerful reminder of your motives, keeping you grounded amidst the ups and downs of trading.

It’s also crucial to set a timeline for achieving your goals. This could involve daily, weekly, or monthly milestones that track your progress. Regularly reviewing these goals will allow you to adjust your strategies as necessary and ensure that you stay aligned with your long-term aspirations.

Tips for Identifying Your Trading Style and Risk Tolerance

You must take the time to identify your trading style and risk tolerance, as these factors greatly influence your trading decisions. Understanding whether you prefer day trading, swing trading, or position trading is vital, as each style requires different strategies and time commitments. Additionally, self-reflection on your comfort with risk will help you determine how much volatility you can handle without losing sleep at night.

- Assess your personality traits—are you patient or impulsive?

- Evaluate your financial situation and how much capital you can afford to lose.

- Consider your time commitment—how much time can you dedicate to monitoring your trades?

After you’ve answered these questions, you will be better positioned to design a trading approach that complements your lifestyle and financial goals.

Some additional tips for identifying your trading style and risk tolerance include considering your past experiences with investments. Evaluate whether you thrive on fast-paced environments or prefer a more deliberate strategy. Ultimately, knowing yourself can lead to making more informed choices.

- Reflect on emotional responses to market fluctuations.

- Explore educational resources and trading forums related to different trading styles.

- Practice with virtual trading to test your comfort levels with risk.

After you have a clearer understanding of your preferences, you can align your trading approach to meet your risk tolerance effectively.

Trading can be a thrilling journey, but it’s crucial to start from a solid foundation. Armed with an understanding of the basics of trading research, setting clear goals, and identifying your trading style and risk tolerance, you will be well on your way to developing a successful trading strategy.

Choosing the Right Research Techniques

It is imperative for you as a beginner to choose the right research techniques to strengthen your trading basics. The methods you select significantly impact the quality and clarity of your analysis. By focusing on specific techniques suited to your learning style and trading goals, you can develop a more robust understanding of market movements and trends. Each technique has its own strengths and weaknesses, and recognizing these will help you navigate your research journey more effectively.

Factors to Consider When Selecting a Research Method

When dicking out a research method, you should consider several factors:

- Your level of experience in trading

- The type of trading you wish to pursue (e.g., day trading, swing trading, long-term investing)

- The markets you prefer to analyze (stocks, forex, commodities)

- The availability of time and resources for research

- Your comfort level with different data analysis techniques

Knowing these factors will allow you to choose a technique that aligns with your personal preferences and trading strategies.

How to Evaluate the Reliability of Trading Data

Techniques for evaluating the reliability of trading data are crucial for avoiding poor investment decisions. Start by scrutinizing the sources of your data and assess their credibility. Reputable financial websites, market reports, and trading platforms often provide reliable information. Ensure that the data you use comes from established sources with a proven track record. Cross-referencing data from multiple platforms can also help verify accuracy, giving you added confidence in your research findings.

Trading data can vary greatly in quality, making it imperative for you to develop a keen eye for detail. Look for signs of bias or manipulation that could mislead you during your analysis. Familiarizing yourself with various data types, such as historical price charts and market news, can help you recognize what reliable data looks like. By cultivating a discerning approach, you’ll be better equipped to make informed trading decisions.

Tips for Avoiding Common Research Pitfalls

Factors that lead to common research pitfalls include not fully understanding the methods you employ or over-relying on a single source of information. To enhance your research skills, keep in mind the following tips:

- Stay diversified in your research techniques to gather a range of insights

- Regularly review and update your strategies based on new information

- Avoid confirmation bias by challenging your preconceived notions

- Engage with a community of traders for shared knowledge and experiences

The insight you gain from a balanced approach to research can significantly enhance your trading proficiency.

Data analysis is an evolving discipline, and it’s vital for you to remain proactive in refining your research skills. Keep seeking new methods that resonate with your trading approach while remaining aware of potential pitfalls. Maintaining this kind of vigilance will help you make more confident and well-informed trading decisions.

- Always verify your data with multiple sources

- Learn from both successful and unsuccessful trades

- Focus on your learning journey—treat mistakes as opportunities for growth

The journey to becoming a proficient trader starts with informed research choices.

Technical Analysis for Beginners

Now that you are entering into the world of trading, understanding technical analysis will be crucial for your success. This aspect of trading focuses on studying historical price movements through charts and employing various indicators to predict future market behaviors. Emphasizing patterns and trends in price action can provide you with insights that are vital for making informed decisions regarding your trades.

How to Read Charts and Identify Patterns

The ability to read charts and identify patterns is a foundational skill in technical analysis. Familiarize yourself with different types of charts, such as line charts, bar charts, and candlestick charts, as they provide valuable visual representations of price movements. Look for common patterns like head and shoulders, flags, and double tops/bottoms, which can indicate potential reversals or continuation of trends. Once you grasp these patterns, you will be better equipped to anticipate market movements and seize trading opportunities.

Tips for Using Indicators and Oscillators

The use of indicators and oscillators can enhance your trading strategy by providing additional data points to support your decisions. Some popular indicators to consider include moving averages, relative strength index (RSI), and MACD (moving average convergence divergence). Each of these tools serves specific purposes, such as identifying overbought or oversold conditions, generating buy or sell signals, or confirming existing trends. Here are some tips to effectively integrate them into your trading:

- Start with a few indicators; avoid overloading your charts.

- Understand how each indicator works and the market conditions it’s best suited for.

- Combine indicators to create a robust trading strategy rather than relying on just one.

- Always confirm your trading decisions with multiple tools or approaches.

Thou must remain aware of how indicators and oscillators can sometimes lag behind market movements; integrating them thoughtfully will enhance your overall approach.

Any trader should note that while indicators and oscillators are helpful, they should not be the sole basis for your trading strategy. Instead, using them as part of a comprehensive trading plan that includes risk management and a solid understanding of fundamental market dynamics is necessary. Keeping a trading journal to record your experiences and outcomes can provide you with insights to improve your strategy further. Here are additional considerations:

- Be patient when waiting for confirmation from indicators before entering trades.

- Keep an eye on market news, as external factors can impact indicator performance.

- Practice in a demo account to gain confidence in using various indicators.

Thou must also remember that practice is key; don’t rush the process of learning how to use these tools effectively.

Understanding the Importance of Trend Analysis

Analysis of market trends is a critical component of technical analysis that can help you determine the general direction of a financial asset’s price. Understanding whether a market is trending upward, downward, or sideways can significantly influence your trading decisions. Typically, traders follow a simple mantra: “the trend is your friend.” By identifying and aligning yourself with prevailing trends, you can enhance your potential for profitable trades.

Using trend lines to visually represent these movements can further augment your analysis. Drawing trend lines can help you identify key support and resistance levels, which are crucial for determining entry and exit points for your trades. As a beginner, consistently monitoring trends will enable you to respond to market changes more adeptly.

Understanding the importance of trend analysis also requires keeping an eye on major economic indicators and news events that can influence market movements. Factors such as interest rates, employment reports, and geopolitical developments can all impact the direction of trends. Recognizing how these elements play a role will empower you to adapt your strategies accordingly.

Fundamental Analysis for Beginners

Despite the various trading strategies available, fundamental analysis remains a cornerstone for beginners hoping to strengthen their trading basics. By analyzing the intrinsic value of assets, you can make informed decisions regarding buy and sell actions. To explore different approaches to trading, refer to this guide on Beginner Trading Strategies that can complement your fundamental analysis skills.

How to Analyze Financial Statements and Reports

Beginners often find it overwhelming to navigate through financial statements and reports, yet these documents are crucial for understanding a company’s health. Start by focusing on the three main financial statements: the income statement, balance sheet, and cash flow statement. Pay attention to key metrics such as earnings per share (EPS), revenue growth, and the debt-to-equity ratio to assess overall performance and stability.

Additionally, be on the lookout for annual reports or 10-K filings, which provide comprehensive insights into a company’s operations, risks, and financial condition. By familiarizing yourself with these documents, you can build a solid foundation for making investment decisions based on your analysis.

Tips for Evaluating Economic Indicators and News

You should never underestimate the importance of economic indicators and news as they significantly impact market trends. Begin by tracking key indicators such as Gross Domestic Product (GDP), unemployment rates, and inflation rates, as they can provide insights into the overall economic climate. Staying updated with financial news will also help you gauge market reactions to current events, ultimately informing your trading strategies.

- Focus on high-impact news that can cause price volatility.

- Monitor central bank announcements and their implications on interest rates.

- Subscribe to financial news outlets for expert analysis.

Any decision you make based on these indicators should align with your trading plans, as being informed helps you minimize risks and seize opportunities.

Understanding the Impact of Market Sentiment

An integral part of fundamental analysis is understanding market sentiment, which reflects the overall attitude of investors toward a particular security or market. It is formulated by collective emotions driven by various factors such as economic data, political events, or earning reports. By keeping a pulse on market sentiment, you can predict price movements more effectively.

Moreover, sentiment analysis can also uncover underlying trends before they manifest in price. If the market sentiment is bullish, you can anticipate a potential rally, while bearish sentiment might indicate a downward trend. By recognizing these shifts in sentiment, you can adjust your trading positions accordingly.

Fundamental analysis is not just about crunching numbers; it is about understanding the bigger picture. You can enhance your approach by combining quantitative data with qualitative factors such as news reports, analyst ratings, and social media trends, giving you a more holistic view of the market dynamics.

- Utilize sentiment indicators such as the Fear & Greed Index.

- Follow social media channels for real-time opinions from traders.

- Analyze the sentiment of significant stocks to gauge overall market direction.

Any insights you gain through understanding market sentiment can bolster your trading strategies and improve your decision-making processes.

Combining Technical and Fundamental Analysis

Once again, it is important for you as a beginner trader to understand that utilizing both technical and fundamental analysis can significantly enhance your trading decisions. Each approach offers unique insights; while technical analysis focuses on price patterns and market trends, fundamental analysis digs deeper into the underlying factors affecting an asset’s value. By merging these two methodologies, you create a well-rounded perspective that can inform your trades more effectively and lead to better outcomes in the market.

How to Use Both Approaches to Inform Your Trades

Now, when you combine technical and fundamental analysis, you’re empowered to identify not only the best entry and exit points for your trades but also gain insights about the overall market sentiment and economic environment. For example, if a company is expected to release strong earnings, understanding the stock’s historical price movements preceding earnings releases using technical analysis can position you to make a more informed trading decision. By aligning your technical indicators with fundamental events, you could execute trades that are timed to maximize potential profit.

Tips for Integrating Multiple Research Techniques

Your trading strategy should include integrating various research techniques that cover both technical and fundamental aspects. Here are some tips to help you achieve a balanced approach:

- Learn about key economic indicators that affect the markets.

- Use charts and technical indicators to analyze price movements.

- Stay informed about news that could impact asset valuations.

- Review historical data to understand past market responses to similar events.

After adopting these tips, you’ll find that having a multi-faceted approach not only enhances your understanding of market conditions but also improves your confidence over trading decisions.

Multiple research techniques will allow you to synthesize information across different domains. This synergistic approach can help you to catch market shifts earlier, as you learn to recognize patterns that resonate with both fundamental data and technical signals. By leveraging insights from earnings reports while analyzing trend lines, for example, you can create a more robust trading plan that accounts for both immediate price action and broader market contexts.

- Be consistent in using the same combination of indicators.

- Adjust your strategies based on real-time developments.

- Focus on long-term trends rather than just short-term fluctuations.

- Be prepared to revise your thesis as new information emerges.

After implementing this approach, you may find your trading performance begins to stabilize and improve.

Factors to Consider When Weighing Different Research Methods

Approaches to weighing different research methods should involve assessing the relevance and reliability of the data you’re using. While one method may provide timely signals, another might offer a more comprehensive view of the factors influencing a market. Carefully consider how recent news events or announcements could impact both fundamental fundamentals and technical charts, always asking how they could shape your market outlook.

- Evaluate the credibility of the information sources.

- Consider the time-frame of your trades – short-term vs. long-term.

- Assess how market conditions may skew the usefulness of certain indicators.

- Balance your personal trading style with your analysis techniques.

Thou will find that understanding these factors not only helps you to make better decisions but also cultivates a mindset that embraces adaptability as market conditions fluctuate.

For instance, understanding that economic reports can sway market sentiment helps you weigh when to rely more heavily on fundamental analysis. Alternatively, if you’re in a highly volatile market, technical indicators may guide your trading decisions better. Being able to pivot between these methods based on prevailing conditions can improve your effectiveness as a trader.

- Determine how often you’ll review news and alter your strategy accordingly.

- Stay flexible with your analysis, adapting as needed.

- Use a trading journal to note down the outcomes of different approaches.

- Collaborate with other traders to gain new insights.

Thou may discover that this evolving strategy shapes your trading acumen over time, enabling you to make more informed choices in the markets.

Avoiding Common Mistakes in Trading Research

For beginners in trading, avoiding common mistakes can significantly enhance your chances of success. Often, traders fall into the traps of emotional decision-making, risk mismanagement, and the overwhelm of over-analysis. Recognizing these pitfalls early on is crucial to develop resilient trading habits that lead to sustainable profits.

How to Avoid Emotional Decision-Making

Assuming that emotions won’t affect your trading is a common misconception among beginners. The reality is that the highs and lows of trading can provoke strong emotional responses, such as fear and greed. To combat this, developing a solid trading plan and sticking to it is crucial. Write down your strategies, including entry and exit points, and always refer back to them during times of market volatility to help reduce impulsive decisions driven by emotions.

Another effective strategy is to utilize trading journals to track your thoughts and feelings during trades. Reflecting on your emotional state and decision-making process can help you identify patterns over time. This self-awareness will enable you to differentiate between rational analysis and emotional impulses, ultimately leading to better trading outcomes.

Tips for Managing Risk and Staying Disciplined

Common mistakes in risk management often stem from a lack of discipline or a failure to adhere to predetermined risk limits. To effectively manage risk, you should establish stop-loss orders and only invest a small percentage of your trading capital on any single trade. By doing so, you create a safety net that helps to mitigate significant losses, allowing you to stay in the game longer.

- Set clear risk/reward ratios for every trade you enter.

- Regularly review your trading plan and adjust it as needed.

- Limit the number of trades you execute per day to prevent overload.

Any successful trading strategy incorporates risk management as a fundamental principle. If you become too lax with your discipline, you risk falling back into bad habits that can derail your progress.

Understanding the Dangers of Overtrading and Analysis Paralysis

It’s crucial to recognize the dangers of overtrading and analysis paralysis, both of which can severely impact your success as a trader. Overtrading occurs when you make too many trades, often spurred by the desire to recover losses or capitalize on fleeting market movements. This behavior can lead to emotional exhaustion and financial strain, hindering your overall performance.

Similarly, analysis paralysis happens when you become bogged down in the details, overanalyzing information and failing to make timely decisions. The key to overcoming this pitfall is to set clear criteria for your trades and stick to them. Having rules in place can streamline your decision-making process, helping you to avoid getting lost in a sea of data.

Understanding the dangers of overtrading and analysis paralysis is vital for effective trading practices. Focusing on a few well-thought-out trades can yield more positive results than chasing numerous opportunities based on impulsive judgments.

Staying aware of how these factors impact your trading can enhance your performance and help you develop a more systematic approach.

- Establish a fixed number of trades you want to execute each day or week.

- Dedicate specific times for research and trading, avoiding constant monitoring of the market.

- Seek feedback from more experienced traders to assess your strategies.

Any trader can benefit from maintaining a balanced perspective, ensuring they engage with the market thoughtfully rather than reactively.

Conclusion

With this in mind, it’s vital for you as a beginner trader to examine various research techniques that will significantly strengthen your trading basics. Start by familiarizing yourself with fundamental analysis to understand the underlying factors that impact market behavior, such as economic indicators, financial news, and earnings reports. Additionally, technical analysis is crucial for interpreting price movements and identifying trading opportunities. Utilize charting tools and indicators to assess trends and make informed decisions. Empower yourself with knowledge through reputable financial websites, books, or online courses that cater to novice traders.

Moreover, don’t underestimate the value of paper trading. By simulating trades without financial risk, you can practice your strategies and gain confidence in your decisions. Engaging in trading communities, whether online or in person, allows you to share insights and learn from more experienced traders. Be mindful of, the key to success in trading is continuous learning and adaptation. As you apply these research techniques, you not only bolster your trading fundamentals but also cultivate a mindset geared for long-term growth and resilience in the ever-evolving market landscape.

FAQ

Q: What are the most important research techniques for beginners in trading?

A: Beginners should focus on fundamental analysis, technical analysis, and sentiment analysis. Fundamental analysis involves evaluating a company’s financial health through reports and earnings. Technical analysis uses historical price data to predict future movements. Sentiment analysis looks at market psychology, understanding how traders feel about certain assets.

Q: How can beginners effectively use fundamental analysis?

A: Beginners can start by reading financial statements, such as income statements, balance sheets, and cash flow statements. Learning the key financial ratios, like P/E ratio, debt-to-equity ratio, and ROI, can also provide insights into a company’s performance. Resources like financial news, market analysis, and economic indicators are crucial for a foundational understanding.

Q: What role does technical analysis play in trading?

A: Technical analysis helps traders understand the price movements of stocks or assets by using charts and indicators. Beginners should familiarize themselves with basics such as trend lines, moving averages, and support/resistance levels. Learning how to interpret various chart patterns can provide insights into potential price movements.

Q: How can one assess market sentiment effectively?

A: To assess market sentiment, beginners can utilize tools like surveys (e.g., Consumer Confidence Index), social media sentiment analysis, and news headlines. Following sentiment indicators, such as the Fear & Greed Index, can also provide an overall view of market emotions and trends.

Q: What online resources are useful for beginner traders?

A: There are various online platforms and resources available for beginner traders. Websites like Investopedia, Yahoo Finance, and trading platforms like TD Ameritrade and E*TRADE offer educational materials, articles, and webinars. Forums and community groups can also provide valuable insights and discussions among novice traders.

Q: How can beginners develop their own trading strategies using research?

A: Beginners should start by documenting their research findings and observing patterns in the market. Setting defined trading goals, risk tolerance, and time frames will help in developing a strategy. It’s important to backtest strategies on historical data and continuously refine them based on the trader’s experiences and evolving market conditions.

Q: What common mistakes should beginners avoid when doing research for trading?

A: Common mistakes include relying solely on one type of analysis, neglecting to stay updated with market news, and overtrading based on impulse rather than thorough research. Additionally, beginners should be cautious of emotional decision-making and make sure they have a clear strategy in place before entering trades.